I wish more people shared the sentiment of just wanting a home and not an investment. I don’t care how much my house goes up or down in speculative value.

Then, rent? It’s actually cheaper to rent a home than buy it these days in most cases. You also don’t need to spend money on upgrades and repairs.

Edit: the downvotes and general backlash against this comment likely all come from folks who don’t own a home and don’t really know the stakes because they haven’t been in a position to consider them. It’s mob mentality. Around me a house is a $10k/monthly payment, renting is $5k. Renting is a no brainer, especially considering that you don’t need to make repairs. The $10k/month is the minimum you’ll pay. Need a new HVAC? 20k. Need a new roof? 40k. Need to remodel an outdated part of the house? 10-60k. Garage door spring broke? $350. Plumber fixed a leak? $500. Need an exterminator to kill some rodents? $150. Tree removal to take down a dangerous tree? $3k. These are all costs that you’ll eventually need to pay as an owner. Given this and the fact that being a landlord involves taking a financial risk on a tenant, buying should be cheaper than renting. If you think of being a landlord like running a business, you’ll quickly realize that no business would operate at a loss willingly for long. Well, when renting is cheaper than buying, that’s essentially what is happening. The market is such that buyers are paying a premium for an asset they can’t get much of a return on, so you’re better off renting. This was actually one of the indicators that predictors of the 2008 housing crash looked at. But, go ahead, tell me I’m an idiot. Follow the mob. Recite platitudes. Don’t think critically or evaluate the nuance in things, it’s your money, not mine.

No. I want the freedom of changing my house to my exact liking and renting doesn’t allow for that. Furthermore if I’m renting, then I’m paying for someone else’s speculative property.

Prices around me are insane. It’s twice the monthly payment to buy than to rent. And, that’s before spending on repairs and upgrades. This means most people are not buying to speculate because there is very little upside and no way to cover the monthly costs by finding a renter.

Where are you?

California

It’s rarely cheaper to rent when you factor in that you’ll never own the asset.

Prices around me are insane. It’s twice the monthly payment to buy than to rent. And, that’s before spending on repairs and upgrades. In my area, renting is much cheaper than buying. This was actually a signal predictors of the 2008 crash used.

Tenants care a lot about the housing market going up and down, because it affects how much their rent will increase.

This is moronic advice.

I’d rather own my home and not worry about some asswipe jacking up rent.

If you rent every cent that goes towards rent is paying someone else’s mortgage and you’ll never see that money again.

If my home value goes down I still have equity. I can sell and regain at least some of that money instead of flushing all of it down the toilet.

Rent is skyrocketing right now. My mortgage is still the same. If I were renting I’d be much worse off.

You’re making several assumptions in your comment.

-

Like a landlord can raise rent infinitely at will. This is not true. Renting is a market. It’s why renting is cheaper than buying right now. Don’t you think the people buying right now with high prices and high interest rates would like to know they can rent their property for the same price as their monthly costs? Yes. Then why don’t they? Because the rental market is a market. They might try to charge a tenant the $5k/month they’re paying for their mortgage + tax + insurance, but if the going rate is $2.5k, there is no way they can raise rent to that level. Also, depending on where you live, your monthly payment can be very much dependent on property taxes. It may not be the landlord raising your monthly payment, instead it will be the local government. All that increase in equity on your home just becomes extra money every year that you’ll shell out to the city or county.

-

If you rent, you’re basically paying to live in a house as a service. You have almost zero risk. Your monthly payment is locked in for 12 months. If anything needs repair, you aren’t on the hook. How awesome! That $40k roof replacement? Not your problem. Random $1k furnace repair? $500 plumbing bill? $350 garage door spring replacement? $1500 termite tenting bill? $100 rodent extermination bill. None of your problems! Renting is fixed cost, low stress, and pretty much risk free. If you’re an owner, all those bills are your problem and it’s also money that you aren’t going to see again. All properties will eventually have these costs.

If your home value goes down, I still have equity. I can sell and regain at least some of that money…

Not necessarily. The moment you buy a property you are underwater on selling fees. Even if you turned around and immediately resold the property for the same price you bought it for, you’re going to lose 5-8% on selling costs. Also, home values don’t always go up all the time. You might have to wait years before you can sell the property for more than a loss. This means you really can’t leave or get out of the property unless you’re willing to take a loss. If you’re a renter, you can pack up as soon as your lease ends and wash your hands of the place.

Also, remember your monthly payment includes taxes and interest. That’s money you won’t get back. Depending on your rate, you’ll likely pay 2-3x the value of your house in interest over a 30 year mortgage. That means even if you sell the property for 2-3x what you bought it for, you’re just breaking even. That doesn’t include the annual tax you’re paying the city or county, or repairs and maintenance.

So, when renting is half the price of buying (which it is around me), you’re better off renting. Buying should be cheaper than renting given all the risks and extra costs I cited above. In a normal market, that would be the case. When it’s not that way, be suspicious.

-

It’s usually cheaper if you don’t plan to stay in the same place for >2 years.

Otherwise no.

“Just pay someone’s mortgage for them, so they can own it when you can no longer afford to live there. Generational wealth should only belong to rich people.”

The problem with a collapse in house prices is that it normally comes with a collapse in everyone’s personal finances.

If you can’t afford before a crash, there’s a very good chance you won’t be able to afford after a crash either.

The only thing that will bring house prices down is building a fuckload more houses, and building them in places that people actually want to live.

You could also introduce regulations to prevent houses being used as investments.

The reason houses are expensive is because investment firms are buying them up with cash.

There are entire neighborhoods owned by investment firms. A lot of these homes are empty and are just used to prop up housing costs.

The issue isn’t supply, it’s policy. The issue is reckless monetary policy combined with banks/investment firms controlling the market.

If you want cheaper housing building more isn’t the answer. The real answer is banning corporations from owning homes.

No that won’t fix it. Not completely anyway. All houses are being bought up by international multi billion dollar investment firms who then proceed to rent out those houses for more than they’re worth, driving up rent prices. Here in Vancouver, Canada, rent prices are beyond ridiculous, and have nothing to-do with what the units are actually worth. If you want to stop that, prohibit companies from owning houses, dead stop. Increase taxes on second, third, and fourth houses exponentially, making it only interesting for a single person to have one, maaaaybe two houses.

With that, houses will become eligible to buy again at normal prices

I mean I was looking out a window in seattle the other day and at least half the rooms in buildings I could see looked empty. I do think there needs to be more laws to punish landlords that have too many vacant units as well.

There was a great video years ago that detailed what would happen if house prices were to rise, fall, or stay stagnant.

You’re right, if they were to crash, we’d all be a lot poorer, but there would also be a lot of (still) cash-rich people that would happily buy up all the cheap stock, and we’d be in an even worse position than before. We’d build more houses, but we’d ultimately create new billionaires, and given the low quality of some new builds, probably a two-timer system of ownership where the poors get the new houses on flood lands/with dodgy cladding, and the rich live in good builds.

The best thing to happen overall is a price cap per-area, dropping by a percent every year or two, with subsidies on sustainable renting (low rent fees, buildings being up to code, etc). The landlords that use their property as investments will bail right away, renters will see the market switch to their favour, and through legislation you could probably push rent-to-sell options for those that maintain homes and want to release over several years.

More homes need to be built, but that also means more infrastructure, and building all of this without selling those houses to the highest bidder. That all takes time, at a time where there are a lot of cash-rich people that would love more investment.

And doing away with Airbnb

I don’t have finances, checkmate

We got a master class in that lesson in 2008.

You’d end up with unhoused boomers.

That’s already going to happen. The ones that can afford to retire are nearly all there, the rest are going to be indigent and need our support lest they become homeless when they are physically too old to work.

America has become a nightmare for most.

Unfortunately, “investors” are buying up properties as fast as they hit the market. The collapse isn’t for a while.

Using your comment to add: never forget Jeff Bezos is now in the game of buying up single family homes to rent out…Try to push your local government to make this shit illegal.

A people can never revolt if they’re too busy, stressed, uneducated and financially weighed down. Whether you believe in the Four Turnings or not, just imagine if you had enough money to accelerate such events, just for profit, just to strengthen your control…

Eat the rich.

Yet another piece of evidence that “xennial” is a real thing. I was born in 1978 and I’m hoping for a collapse in real estate values. I just want a place where I can spend time making it comfortable without the constant awareness that I’ll have to move eventually.

I was born in 86 and I’ve resigned myself to never owning a house because it’s basically impossible unless I want to live in the middle of nowhere or I completely change careers. Four jobs isn’t enough for a house anymore.

Hey fellow xennial! It’s very much a real designation and I’m so glad it’s been defined. I’ve never fit genx or millennial exactly, definitely a combo of both

I’m hoping for a collapse in real estate

It’s not going to happen. The last crash was 2008. Prices went down 30% which didn’t come close to offsetting the increases from the previous run up.

https://dqydj.com/historical-home-prices/

At best there might be a long term oversupply from boomers dying. That would put long term pressure to lower prices. So if you wait 25 years you could have a house priced at what a house was 5 years ago.

Millennial here, bought a house in late 2022, process were not low, but interest was (this was right before all the inflation nonsense that’s plagued the market in the past year or so). Locked in for 3 years.

I don’t care if my overpriced home drops in value. The value we get from owning it is the only thing we care about, and we have no intention of leaving or selling it. So I’m in support of a big crash; unfortunately unless something serious happens I’m not sure that we’ll get a crash.

Every time something inexpensive hits the market it’s snatched up by some investor or something; so the only homes left for normal buyers are overpriced. The businesses that are buying these properties are creating an artificial scarcity and leaving homes empty until they can either rent them for more than they’re worth, or sell it at an incredible markup.

I can see this in action in the neighborhood I live in now. Two new homes were built and they’re up for sale. Naturally I was curious. They both have less floor space, fewer bedrooms, and overall they’re not nearly as valuable, but the market price that’s listed for them is more than double the price we paid for our home less than a block away.

The stupid thing is that they’ll eventually sell probably at that price or something close to it. My home’s value will probably go up by proxy, but honestly, I could not possibly care less. The whole thing is stupid, and unreasonable for normal buyers. They’re modest homes; new, sure, but not special. There’s nothing notably better or variable about the houses. They just cost more.

I’m angry about it. I want families to be able to buy a home. The amount we paid was more than we would normally have been able to afford. We pooled our finances to afford the mortgage, and we’re still struggling to find a balance so that we don’t financially sink trying to afford it. Our situation aside, it should be easier. Others should be able to do it without having to pool resources with others to make it work.

I am also a millennial but fortunately I was able to buy at a decent interest and a decent price. 3 months after I bought my house interest rates skyrocket and so did the value of the house. It’s not the best house but it’s perfect for me. It’s kind of run down and my mom hates it but it’s home. My mom says I should sell it now that it’s worth more but then I asked her where am I going to be able to find a house this cheap anymore? I absolutely hated renting and I’m not a fan of landlords. It does upset me that these large companies are buying up all these properties. Businesses should not own residential homes. PERIOD. I also think the government needs to far more strict on landlords. I was fortunate to have a decent landlord for the 13 years I rented but I’ve heard all the horror stories.

I don’t care if my overpriced home drops in value.

If you have a mortgage, the bank cares. And if the bank cares, it can make you care.

As long as I’m paying my mortgage on time, I can’t possibly imagine that it would be relevant to them to do anything about it.

The only reason the bank cares is because they have a lien on the property for the mortgage which would only be a problem if we defaulted on our payments.

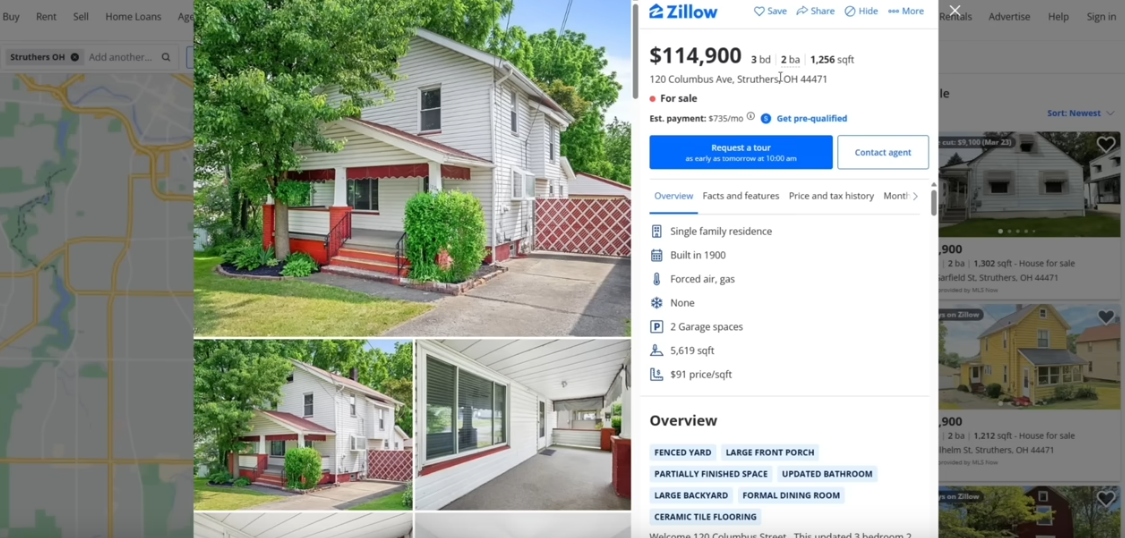

Trying to help my mother in law. Low income, no savings, some debt we’ve tried to help to pay off. Starter homes are over $200k now. 6-7 years ago these are the same houses that were $110-140k. She can’t afford the down payment, hell the bank won’t pre-approve her to even put a bid in. Crazy. And yeah, as others have said, the price won’t go down because any discount will be immediately snatched up, more often by a large investment firm, thus locking the price and not allowing the market to cool.

To provide some context, she wants a very basic home. A small yard primarily to start a garden, maybe 800-1000 sq ft on the high end, and not much more. The only places she and we can find that are in her range are in rough neighborhoods we wouldn’t want her living. And also her work, which is 100% remote, constantly threatens return to office requirements which forces her in a 40 mile vicinity.

As melinneals, we got lucky. Purchased at literally the very beginning of covid (3.20) and have seen our home value skyrocket (+50% from purchase price). Rental homes in the neighborhood regularly charge 90% over our mortgage + property tax + home insurance rate. A house down the street (we got to know them as we both had young puppies) was abandoned because they raised the price +20% in the time the family lived there. It was a mother, both adult children and their spouses, and grandchild, 7 in total, in a 4 bedroom. They left one day and last I saw was an $8k bill taped to the door for 3 months of unpaid rent, they had moved out 4 months prior.

Yeah, I managed to buy at the bottom of the interest rates, but before prices truly skyrocketed.

Because of some other life circumstances, I ended up having to move a few months back and finances just weren’t there to hold onto it.

Having to rent again has been the most mental health destroying financial back step I think I could have ever taken. I pocketed a nice chunk of change, but it’d only be enough for a ~5% down payment in the current town.

Hoping to get back to owning some day, but not hopeful that that day will be soon.

she wants a very basic home. A small yard primarily to start a garden, maybe 800-1000 sq ft on the high end, and not much more.

…and…

And also her work, which is 100% remote,

This one is one hour outside Pittsburgh and 1.5 hours outside of Cleveland. So you’re still close two a couple sizable international airports, theaters, museums with great food scenes. Both cities host large Universities so you’re close to a fairly highly educated population.

If only you had read a bit more to see that her work keeps threatening return to office.

I saw it. Lots of orgs are threatening. Very few have actually acted on it. I wanted that poster to have the info about options.

You’re not wrong. I appreciate the info. That’s exactly what she’s looking for. Thank you for looking. We’re always on the lookout.

And if she’s already working from home she probably has skills she can apply to other remote jobs. I say start applying now.

If thisbis his mother in law i am gonna assume she is in her 50’s to 60’s. It’s hard to get an office job at that age since she likely isn’t too far away from retirement age

I think this is one of few things where employees are successfully putting their collective foot down. I’ve seen several companies announce return to office and then walk it back just a few days later after an enormous portion of the workforce threatens to leave.

What do you mean by “hanging young puppies”? I’m very concerned

Glad I’m not the only one who caught that, that’s a strange hobby for sure.

Lol. All the puppies are healthy! Fixed the typo.

Your house didn’t increase 50% in four years, that’s the kind of unrealistic investment expectation that makes the housing market unaffordable. That’s not going to get fixed no matter how many houses are built. People ask unreasonable amounts of money for their shitbox (not saying your house is a shitbox) even if it’s on a bad piece of land. I am not sure what’s the solution for this other than teaching people critical thinking skills for objectively evaluating things.

But an “easy” one for a separate but related problem: corporate investors need to be legislated out of owning single family houses.

Except many housing markets have been doing exactly that for the past decades. Also with the period of hyper inflation we went through easily means the house has gained about 30% value purely through being a durable good that holds it’s value with inflation. Another 20% due to the crazy '21-'22 housing market plus general “most houses gain value” housing market is not hard to believe

Hmm, 50% in 4 years? I haven’t seen the data so it’s hard for me to say either say. Maybe you’re right.

Edit: or if you’re going to make claims, then the onus of providing data and facts is on you, I think. OTOH, with crazy trends like NFTs and speculative stocks, I don’t know what to believe.

Yep and all the banks are waiting as well, so they can buy even more properties to rent out.

There is a strong correlation between unaffordable homes and people voting strong men and far right. It’s a policy choice to stop the “homes as an investment”, a policy that advantages the rich the most. But that policy choice determines where society will go.

Where I live, they’re now taxing people that own properties where nobody lives. It won’t be enough, but we’ll see.

Okay well we’ve had three years without a strong man president and all we’ve gotten are higher interest rates and a letter telling us the economy is doing great. Not even an acknowledgement of the problem, let alone expressed interest in solving it, or a plan, or action.

This is on the blues right now. They need to do something fast if you don’t want a strong man president.

How’s unemployment right now? The debt is solely on the shoulders of someone downplaying issues from a crazy sickness. Telling them to just drink bleach. And then needing to try and save everything Since we couldn’t take it seriously early enough that we then had to bail ourselves out. And not even trickle down like reds like. But they actually had to feed everyone or the housing and well literally every commodities market was going to collapse. We gained 8 trillion dollars in debt last time a Republican was in office and the worst unemployment numbers since the great depression. Good thing someone came in behind and cleaned up the hot mess Republicans left us in.

How does any of that prevent Biden from acknowledging that housing is expensive and a desire to incentivize housing construction for individual ownership?

I’m not asking for the moon here. Silence on the matter is a very loud statement about keeping things the way they’re headed. They’ll get a rude referendum on that. No one will be happy with the outcome.

We’re still recovering from the impact of a previous President who openly and regularly promoted a complete disregard for public safety during a literal pandemic.

dork

Good luck … genx have been waiting as well

For our whole lives. Of course we saw a massive crash in 2008, but we also lost our jobs and all of our money, and most of us couldn’t capitalize on it.

It’s never going to collapse.

That’s the joke

Supply and demand. House prices are high because lots of buyers are financially competing for the same properties. The prices won’t collapse unless something disastrous happens to the world that results in an oversupply of housing or massively harms people’s spending power, and the odds are you would be affected by that too.

There are currently 10 million vacant homes across the US, (15 million if you count the ones for rent,) which represents about 7.5% of the total housing. Not refuting your argument, just adding to the conversation.

I guess a lot of these are in less than desirable locations, among other factors, but 4.5 million of them are listed as seasonal, occasional, or recreational use. That’s a lot of vacant housing, considering only 1.2 million of them are for sale.

Edit, I guess these are 2020 numbers so these may have changed since then.

Just need boomers to die off. That’ll get some houses on the market.

We never should have talked them out of eating horse de-wormer

Me too

If you want to make the market crash, you gotta make renting look like a poor investment. Like what if rental units had a high chance of catching fire or something? That would be a shame wouldn’t it.

Yes let’s burn all the houses down. That surely will fix everything. /s