“If we want the digital Euro to become a success, we need a clear and convincing narrative of why we need it in the first place. People need to see the benefits of a digital Euro in their day-to-day lives. The European Central Bank and the European Commission have yet to make a compelling case of why we need the digital Euro and what added value it will deliver,” explained Markus Ferber MEP, the EPP Group Spokesman in the European Parliament’s Economic and Monetary Affairs Committee.

I mean for one you’re not actually transferring Euros when you use your EC card, or use your bank account in general: You’re using Bank Euros, which the bank promises it can back with ECB Euros but if you look at its balance sheets then it will have too few ECB Euros to back everything because that’s what fractional reserve banking means: If you put 100 ECB Euro on your bank account your bank has to deposit one ECB Euro with the ECB, it can do whatever (within the law) with the rest. Like depositing a further 50 ECB Euros with the ECB and adding 5000 Bank Euros to your account and calling it a credit.

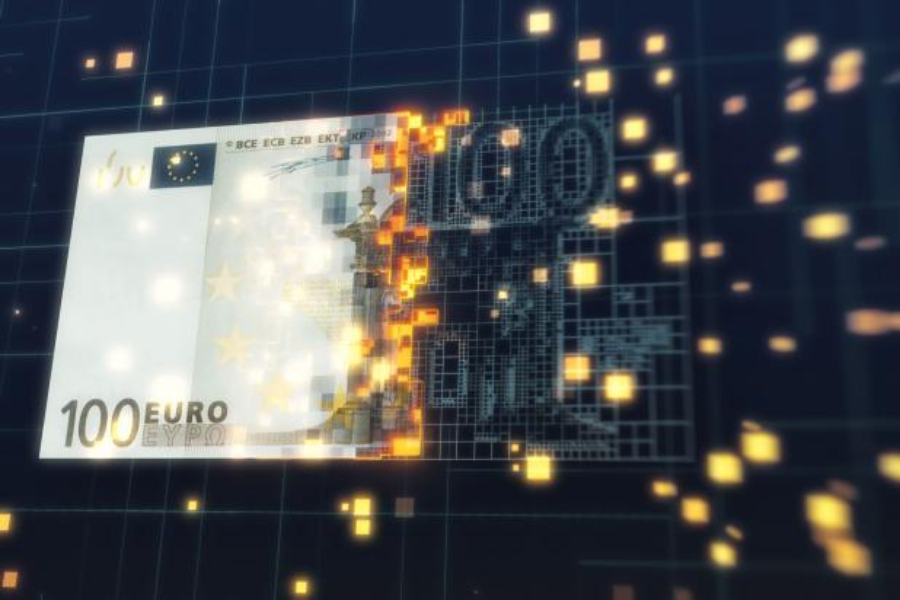

Coins and notes are actual ECB Euros, the real deal, no ordinary banks involved. The digital Euro allows that kind of immediacy also in, well, the digital space.

It may just stand on its own, or it might be an ingredient in full reserve banking down the line. In particular it would allow the ECB to increase and decrease monetary supply very freely without having to rely on the whims of other banks, that was especially an issue in the financial crisis where no matter how cheap the ECB was lending out money to the banks, they wouldn’t use it to give loans to customers. The ECB can’t really fulfill its mandate of price stability if it doesn’t have proper control of the supply of the kind of money that people are actually using, which increasingly is electronic and thus non-ECB Euros.